Fast Cash Approvals

500,000 Customers

Payment terms

Flexible payments

We Give you The Best Financial Assistance You Can Ever Have,

Professional Confidential Financial Services

Loans for most purposes

WHY FINANCE WORLDWIDE

Our funding process

Application Submission

Apply with a name and simple Business Information

Application Review

It will be reviewed and approved within 24-48 hours.

Funds Release

Depending on a funding category applied, funs are normally approved and released within 2-5 days.

Things to know about us

WE OFFER

Asset Financing

Asset Financing, tell us about that asset for your personal use or that equipment for that business, let help achieve the finance you need to make your dreams come alive.

Business Finance

We specialize in business lending and providing a permanent lending solution to our clients, we are aware that business owners needs innovative and flexible lending and banking solution

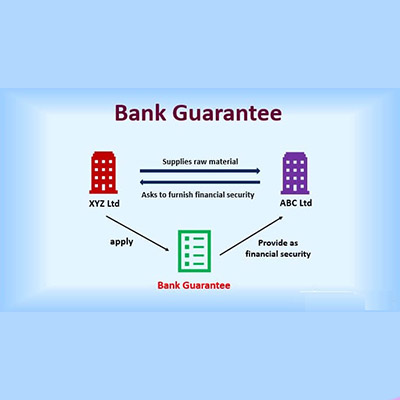

Standby Letter of Credit

The bank issuing the SBLC will perform a brief underwriting procedure to ensure the credit worthiness of the party applying for the SBLC, before issuing the SBLC to its beneficiary.